Capital-Meaning,Uses,Types-Debt Capital,Equity Capital,Working Capitals,Business Capital Structure,Capital vs. Money (Commerce Achiever)

Capital is a broad term that describes something that confers value or benefit for the possessor, such as a factory and its machinery, intellectual property like parents, or the financial assets of a business or an individual.  While money itself may be construed as capital is, capital is more often associated with cash that is being put to work for productive or investment purposes.

While money itself may be construed as capital is, capital is more often associated with cash that is being put to work for productive or investment purposes.

In general, capital is a critical component of running a business from day to day and financing its future growth. Business capital may derive from the operations of the business or be raised from debt or equity financing. When budgeting, businesses of all kinds typically focus on three types of capital: working capital, equity capital, and debt capital. A business in the financial industry identifies trading capital as a fourth component.

- The capital of a business is the money it has available to pay for its day-to-day operations and to fund its future growth.

- The four major types of capital include working capital, debt, equity, and trading capital. Trading capital is used by brokerages and other financial institutions.

- Any debt capital is offset by a debt liability on the balance sheet.

- The capital structure of a company determines what mix of these types of capital it uses to fund its business.

- Economists look at the capital of a family, a business, or an entire economy to evaluate how efficiently it is using its resources.

Understanding Capital

From the economists’ perspective, capital is key to the functioning of any unit, whether that unit is a family, a small business, a large corporation, or an entire economy.

In the broadest sense, capital can be a measurement of wealth and a resource for increasing wealth. Individuals hold capital and capital assets as part of their net worth. Companies have capital structures that define the mix of debt capital, equity capital, and working capital for daily expenditures that they use.

Capital is typically cash or liquid assets being held or obtained for expenditures. In a broader sense, the term may be expanded to include all of a company’s assets that have monetary value, such as its equipment, real estate, and inventory. But when it comes to budgeting, capital is cash flow.

How individuals and companies finance their working capital and invest their obtained capital is critical for their prosperity.

How Capital Is Used

Capital is used by companies to pay for the ongoing production of goods and services in order to create profit. Companies use their capital to invest in all kinds of things for the purpose of creating value. Labor and building expansions are two common areas of capital allocation. By investing capital, a business or individual seeks to earn a higher return than the capital’s costs.

At the national and global levels, financial capital is analyzed by economists to understand how it is influencing economic growth. Economists watch several metrics of capital including personal income and personal consumption from the Commerce Department’s Personal Income and Outlays reports. Capital investment also can be found in the quarterly Gross Domestic Product report.

Typically, business capital and financial capital are judged from the perspective of a company’s capital structure. In the U.S., banks are required to hold a minimum amount of capital as a risk mitigation requirement (sometimes called economic capital) as directed by the central banks and banking regulations.

Other private companies are responsible for assessing their own capital thresholds, capital assets, and capital needs for corporate investment. Most of the financial capital analysis for businesses is done by closely analyzing the balance sheet.

Business Capital Structure

A company’s balance sheet provides for metric analysis of a capital structure, which is split among assets, liabilities, and equity. The mix defines the structure.

Debt financing represents a cash capital asset that must be repaid over time through scheduled liabilities. Equity financing, meaning the sale of stock shares, provides cash capital that is also reported in the equity portion of the balance sheet. Debt capital typically comes with lower rates of return and strict provisions for repayment.

Some of the key metrics for analyzing business capital are weighted average cost of capital, debt to equity, debt to capital, and return on equity.

Types of Capital

Below are the top four types of capital that businesses focus on in more detail

Debt Capital

A business can acquire capital by borrowing. This is debt capital, and it can be obtained through private or government sources. For established companies, this most often means borrowing from banks and other financial institutions or issuing bonds. For small businesses starting on a shoestring, sources of capital may include friends and family, online lenders, credit card companies, and federal loan programs.

Like individuals, businesses must have an active credit history to obtain debt capital. Debt capital requires regular repayment with interest. The interest rates vary depending on the type of capital obtained and the borrower’s credit history.

Individuals quite rightly see debt as a burden, but businesses see it as an opportunity, at least if the debt doesn’t get out of hand. It is the only way that most businesses can obtain a large enough lump sum to pay for a major investment in its future. But both businesses and their potential investors need to keep an eye on the debt to capital ratio to avoid getting in too deep.

Issuing bonds is a favorite way for corporations to raise debt capital, especially when prevailing interest rates are low, making it cheaper to borrow. In 2020, for example, corporate bond issuance by U.S. companies soared 70% year over year, according to Moody’s Analytics. Average corporate bond yields had then hit a multi-year low of about 2.3%.

Equity Capital

Equity capital can come in several forms. Typically, distinctions are made between private equity, public equity, and real estate equity.

Private and public equity will usually be structured in the form of shares of stock in the company. The only distinction here is that public equity is raised by listing the company’s shares on a stock exchange while private equity is raised among a closed group of investors.

When an individual investor buys shares of stock, he or she is providing equity capital to a company. The biggest splashes in the world of raising equity capital come, of course, when a company launches an initial public offering (IPO). In 2020, new issues appeared from young companies including Palantir, DoorDash, and Airbnb.

Working Capital

A company’s working capital is its liquid capital assets available for fulfilling daily obligations. It is calculated through the following two assessments:

- Current Assets – Current Liabilities

- Accounts Receivable + Inventory – Accounts Payable

Working capital measures a company’s short-term liquidity. More specifically, it represents its ability to cover its debts, accounts payable, and other obligations that are due within one year.

Note that working capital is defined as current assets minus its current liabilities. A company that has more liabilities than assets could soon run short of working capital.

Trading Capital

Any business needs a substantial amount of capital in order to operate and create profitable returns. Balance sheet analysis is central to the review and assessment of business capital.

Trading capital is a term used by brokerages and other financial institutions that place a large number of trades on a daily basis. Trading capital is the amount of money allotted to an individual or the firm to buy and sell various securities.

Investors may attempt to add to their trading capital by employing a variety of trade optimization methods. These methods attempt to make the best use of capital by determining the ideal percentage of funds to invest with each trade.

In particular, to be successful, it is important for traders to determine the optimal cash reserves required for their investing strategies.

A big brokerage firm like Charles Schwab or Fidelity Investments will allocate considerable trading capital to each of the professionals who trade stocks and other assets for it.

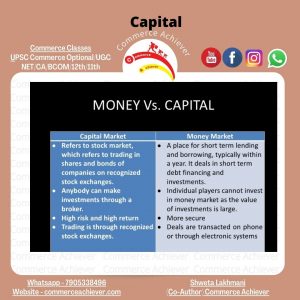

Capital vs. Money

At its core, capital is money. However, for financial and business purposes, capital is typically viewed from the perspective of current operations and investments in the future.

Capital usually comes with a cost. For debt capital, this is the cost of interest required in repayment. For equity capital, this is the cost of distributions made to shareholders. Overall, capital is deployed to help shape a company’s development and growth.