Selection of Accounting Policies-The considerations are: 1. Accurate Presentation 2. Conservatism 3. Profit Maximization 4. Income Smoothing (Commerce Achiever)

- Posted by commerce achiever1

- Categories Accounts, Blogs, Learn - Free

- Date May 19, 2021

Selection of Accounting Principles: 4 Considerations

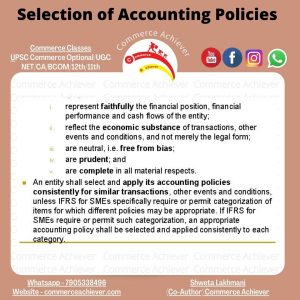

The following points highlight the four main considerations which guide the selection of accounting principles. The considerations are: 1. Accurate Presentation 2. Conservatism 3. Profit Maximization 4. Income Smoothing.

The following points highlight the four main considerations which guide the selection of accounting principles. The considerations are: 1. Accurate Presentation 2. Conservatism 3. Profit Maximization 4. Income Smoothing.

Consideration # 1. Accurate Presentation:

One of the criteria for assessing the usefulness of accounting information is accuracy in presentation of the underlying events and transactions. This criterion may be used by the firm as a basis for selecting accounting principles and methods. For example, assets have been defined as resources having future service potential and expenses defined as a measurement of the cost of services consumed during the period.

In applying the accuracy criterion, the firm would select the inventory cost flow assumption and depreciation method that most accurately measure the amount of services consumed during the period and the amount of services still available at the end of period.

As a basis for selecting an accounting principle, this approach has at least one serious limitation. It is difficult to know accurately the services consumed and the service potential remaining.

Without this information, the accountant cannot ascertain which accounting principles lead to the most accurate presentation of the underlying events. This criterion can serve only as a normative criterion toward which the development and selection of accounting principles should be directed.

Consideration # 2. Conservatism:

In choosing among alternative generally acceptable principles, the firm may select the set that provides the most conservative measure of net income. Considering the uncertainties involved in measuring benefits received as revenues and services consumed as expenses, some have suggested that a conservative measure of earnings should be provided.

Conservatism implies that methods should be chosen that minimize cumulative reported earnings. That is, expenses should be recognised as quickly as possible and the recognition of revenues should be postponed as long as possible.

This reporting objective, for example, would lead to selecting an accelerated depreciation method, selecting the LIFO cost flow assumption if periods of rising prices are anticipated, expensing research development cost in the year incurred.

Consideration # 3. Profit Maximization:

A reporting objective having an effect opposite to conservatism may be employed in selecting among alternative generally accepted accounting principles. Somewhat loosely termed reported profit maximization, this criterion suggests the selection of accounting principles that maximize cumulative reported earnings.

That is revenue should be recognized as quickly as possible, and the recognition of expense should be postponed as long as possible. For example, the straight-line method of depreciation would be used, and when periods of rising prices were anticipated, the FIFO cost flow assumption would be selected.

The use of profit maximization as a reporting objective is an extension of the notion that the firm is in business to generate profits, and it should present as favourable a report on performance as possible within currently acceptable accounting methods.

Some firm’s managers whose compensation and salary depends in part on reported earnings, prefer larger reported earnings to smaller. Profit maximization is subject to a similar criticism as the use of conservatism as a reporting objective. Reporting income earlier under the profit maximization criterion must mean that smaller income will be reported in some later period.

Consideration # 4. Income Smoothing:

A final reporting objective that may be used in selecting accounting principles is income smoothing. This criterion suggests selecting accounting methods that result in the smoothest earnings trend over time.

Advocates of income smoothing suggest that if a company can minimize fluctuations in earnings, the perceived risk of investing in shares of its stock will be reduced and, all else being equal, its stock price will be higher.

It is significant to note that this reporting criterion suggests that net income, net revenues and expenses individually, is to be smoothed. As a result, the firm must consider the total pattern of its operations before selecting the appropriate accounting principles and methods.

For example, the straight-line method of depreciation may provide the smoothest amount of depreciation expense on a machine over its life. If, however, the productivity of the machine declines with age so that revenues decrease in later years, net income using the straight-line method may not provide the smoothest net income stream.

Due to the flexibility permitted in selecting accounting principles, it is generally now required that business enterprises will disclose the accounting principles used in preparing financial statements, either in a separate statement or as a note to the principal statements.

Although a business firm can use different accounting principles for different purposes, this does not necessarily mean that business enterprises may keep more than one set of records to satisfy the different requirements. In most cases, certain items taken for financial accounting purposes may have to be omitted and certain other items may have to be included for determining taxable income and tax liability.

Even if an organisation maintains different sets of records and books, one for financial reporting purposes and the other for income tax reporting purposes, this practice cannot be said to be illegal or unethical.

In fact, there is nothing wrong or illegal about keeping separate records to fulfil separate needs, so long as all the records and books are open to examination by the appropriate parties. However business enterprises attempt to meet the different requirements of shareholders and investors (through financial reporting) and tax authorities (through tax reporting) using the same set of data.

Tag:CAfoundation, CAfoundationaAccounts, CAfoundationClasses, CAfoundationEconomic, CAfoundationFees, CAfoundationLaw, CAfoundationRegistration, commerce, commerceachiever, CommerceAndAccountancy, CommerceBaba, Selection of Accounting Policies, The considerations are: 1. Accurate Presentation 2. Conservatism 3. Profit Maximization 4. Income Smoothing

You may also like